Interest rates are back at the centre of the property conversation as Sydney buyers look to the year ahead. After a year of strong housing gains across much of the country, the outlook has shifted towards moderation, with economists, lenders and market analysts closely watching inflation and Reserve Bank of Australia (RBA) policy.

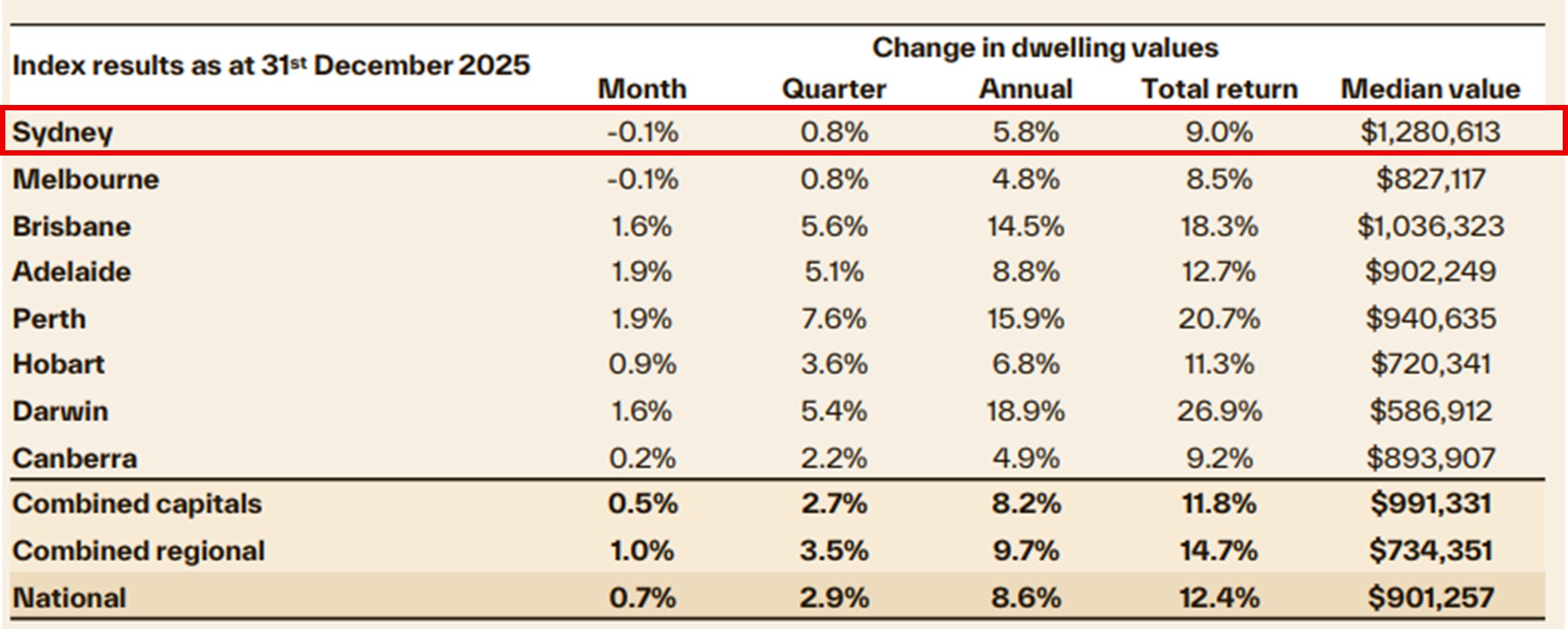

National housing data from Cotality shows momentum eased at the end of 2025, with dwelling values rising just 0.7% in December, the smallest monthly increase in five months. Sydney and Melbourne recorded modest month-on-month declines of 0.1%, while most other capitals continued to see growth.

Despite this pause, and the rate of change slowing considerably towards the end of 2025, average Sydney home values increased 5.8% over the year, leaving prices materially higher than a year earlier. Whilst average price movements tell a story, they often mask the localised changes that are happening from suburb to suburb, or on a regional level, such as the Lower North Shore where the outcomes have been more variable.

Interest rates and buyer sentiment

The question now is how interest rates may shape buyer behaviour in the year ahead. According to the Australian Financial Review’s quarterly survey of economists, views are sharply divided. Some expect rate hikes as early as February if inflation remains elevated, while others believe the RBA may hold steady through much of 2026 as it balances inflation control with economic growth.

This lack of consensus has impacted sentiment, with confidence cooling as markets reassess what comes next. When buyers cannot predict whether rates are headed up, down or remaining on hold, many become more cautious about timing and budgets. That uncertainty flowed through to buyer behaviour last year, particularly at higher price points where borrowing costs matter most.

Consistent with the late-year slowdown already evident in Sydney and Melbourne, alternative price measures also point to a broader easing in momentum. PropTrack data shows national dwelling prices recorded only marginal growth through December, as interest rate expectations weighed on buyer activity.

A more measured market, not a retreat

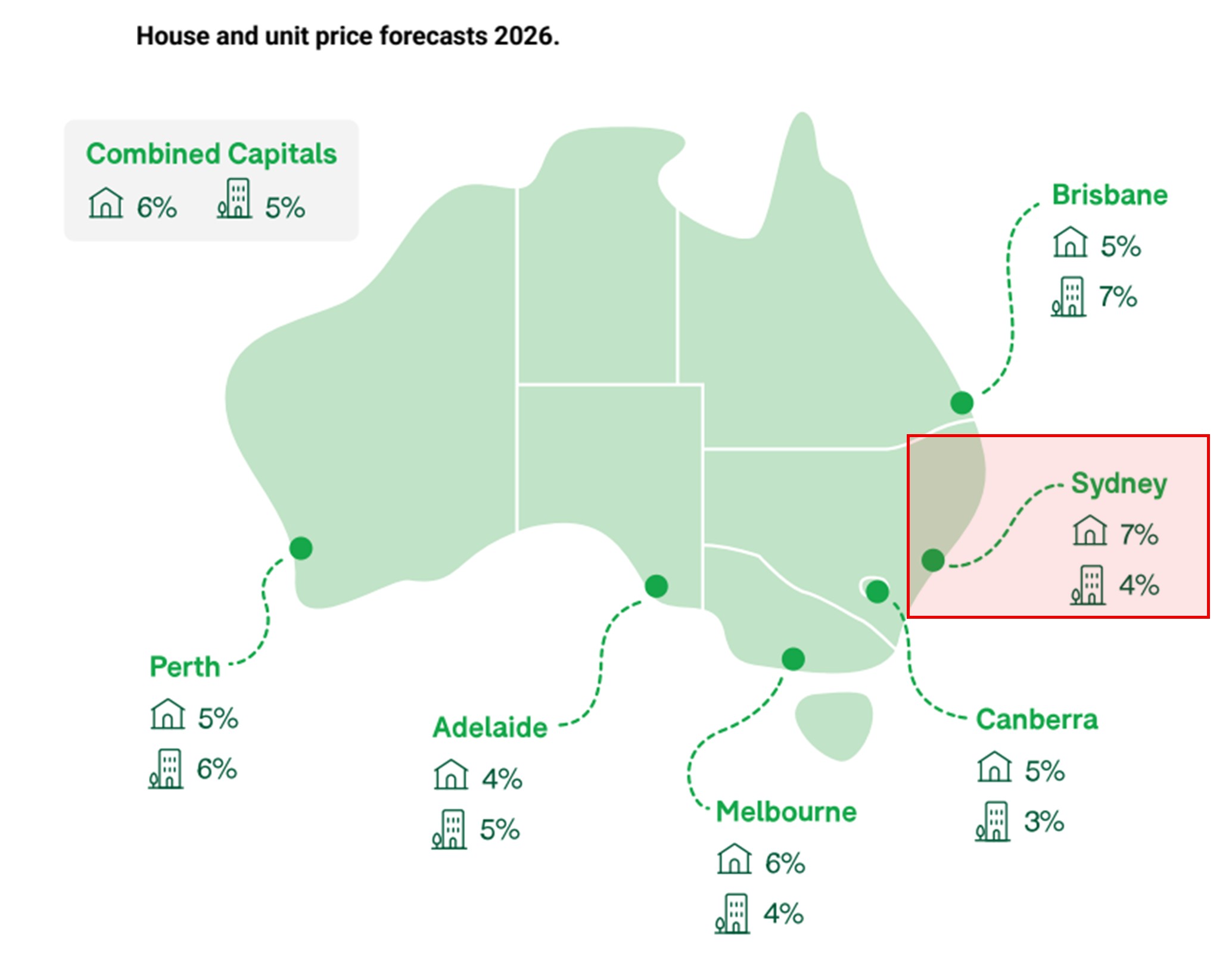

Looking ahead, analysts broadly expect price growth in Sydney to slow rather than reverse. PropTrack forecasts Sydney dwelling prices will rise by around 5% to 7% over 2026. While tighter affordability and higher borrowing costs will put downward pressure on price growth, ongoing housing shortages, population growth and policy support are expected to have the opposite effect.

Domain’s outlook aligns with this view, describing 2026 as a more subdued year following the gains in 2025. Its research anticipates continued price growth nationally, albeit at a slower pace, with affordability constraints weighing more heavily on higher-priced segments. Sydney house prices are expected to rise 7% over the next 12 months, while unit values are predicted to climb 4%.

What changing market conditions mean for buyers

Across Mosman, Neutral Bay, Cremorne and Cremorne Point, conditions point to a market that is becoming more balanced rather than turning sharply. With activity easing from recent peaks, upsizers may encounter less urgency and more scope for negotiation, while downsizers considering a local move could benefit from greater choice, although suitable stock is likely to remain an issue. Younger buyers aiming to secure an apartment close to family may also find improved opportunities if competition moderates at certain price points.

Interest rate uncertainty remains a key theme, but long-term demand for well-located property in these suburbs continues to be supported by limited supply, lifestyle appeal and proximity to the city. These factors are likely to remain influential as buyers plan their next move in 2026.

Thinking about buying in 2026 and unsure how interest rates may affect your timing or budget? The team at R&W Mosman/Neutral Bay can talk through what the outlook means for your situation and help you plan your next move. Get in touch today.