Interest rates likely to remain on hold until 2026

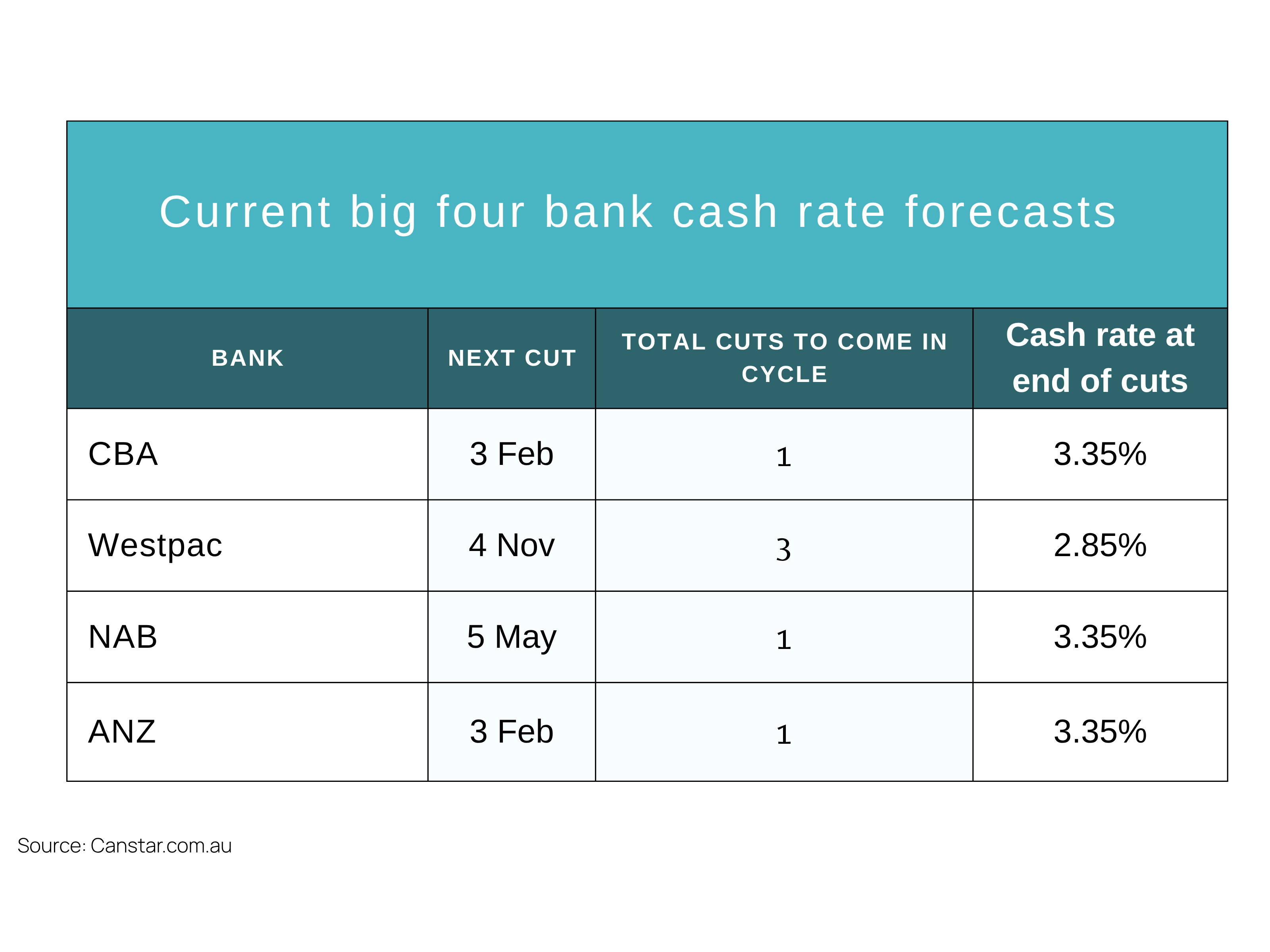

Homeowners hoping for a rate cut this year may have to wait a little longer, with three of the big four banks now forecasting that the Reserve Bank of Australia will hold the cash rate steady until 2026.

ANZ, CBA and NAB expect the first reduction to come in early to mid-next year, while Westpac maintains a slightly more optimistic view but says an earlier move remains uncertain.

With rates set to stay higher for longer, borrowers are being urged to act proactively rather than wait for relief. Reviewing your loan, comparing offers and exploring refinancing options can help lower repayments and improve flexibility.

A well-structured mortgage strategy can also deliver meaningful long-term savings, particularly as lenders compete more actively for quality borrowers.

ANZ, CBA and NAB expect the first reduction to come in early to mid-next year, while Westpac maintains a slightly more optimistic view but says an earlier move remains uncertain.

With rates set to stay higher for longer, borrowers are being urged to act proactively rather than wait for relief. Reviewing your loan, comparing offers and exploring refinancing options can help lower repayments and improve flexibility.

A well-structured mortgage strategy can also deliver meaningful long-term savings, particularly as lenders compete more actively for quality borrowers.